Why greener retail development is good economic strategy

Tom Whittington, Director Commercial Research, Savills and Fellow of the Institute of Place Management

The themes Tom discusses here will be part of an upcoming IPM webinar in the autumn on ‘The Sustainable High Street’. Look out for details later in the year on our events page at Events | Institute of Place Management and in our Member Bulletins.

Retail evolution

Several things will happen in retail property in the coming decade that will cause a fundamental change to how we use and design spaces and who we lease them to.

Changes in occupational requirements and the rise of ecommerce mean that we can support a greater proportion of shopping needs within a smaller amount of floorspace, but consumers will choose to visit more frequently those places that offer a wider range of amenity, wellbeing, service and civic needs than pure retail alone. Blending property uses to meet multiple consumer needs will be more effective in driving footfall and create more interesting and useful places.

Shops will need to reduce energy usage and improve building efficiency; they do after all contribute to 20% of non-domestic property emissions. To fail to do so will not only prove more costly in the long term, but risk creating stranded assets as investors and consumers increasingly move in favour of more sustainable propositions.

These may seem like disparate challenges, but they are not. Resolving them needs to be part of a coordinated strategy. There is good reason to believe that evolving our developments to include social, environmental and economic improvements together will result in more resilient and future proof places.

|

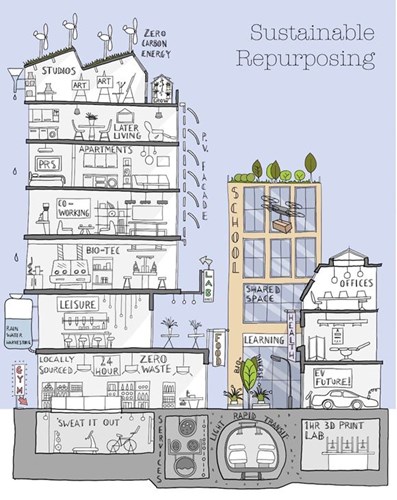

| Above: Designed for Savills by architect Mark Slocombe, who sadly passed away last year. |

Premium or discount?

We’re seeing landlords embedding ESG at the heart of their strategy. For one, investors, policy makers and consumers are becoming increasingly concerned with sustainability. Not being seen to act can have severe consequences for the value of stock. In the future, companies that don’t prioritise ESG may find it more difficult to access funding, or limit the pool of purchasers down the line, which could inhibit growth.

Many institutional retail landlords now acknowledge that sustainable assets are better performing assets. While we may begin to see evidence of a ‘green premium’ over the coming years, it is the notion of asset stranding that may have a bigger impact on the sector and is anticipated for those with the weakest occupational demand and poorest environmental standards. There is a clear correlation between economically and environmentally challenged places when it comes to investment values, so investors and developers need to weigh up the financial cost of action with the financial burden of inaction; those that don’t follow suit are likely to get left behind.

Enhancing value

So how will investors and consumers judge the best from the worst spaces?

Firstly, reducing the energy we use has to be the number one goal. A 20% reduction in energy is equivalent to a 5% increase in revenue so there is a clear financial incentive as well as an environmental benefit. Cleaner energy sourcing or production can make a significant difference, with many retail buildings being well suited to solar generation.

Secondly, the circular economy is one of the most important emerging principles in how we design the built environment. Retail places need to be flexible and agile for reuse and alternative uses, as well as using construction methods that lower the embodied carbon and extend the building’s life. Repurposing failing retail space or creating new developments provides the ideal opportunity to make improvements. And while it may be preferable to reuse buildings to reduce the embodied carbon impact, the reality commercially and practically is that both rebuilding and retrofitting are an important part of the solution.

Thirdly, retail spaces need to not be ‘retail only’ spaces but draw on a range of other uses that meet the wide-ranging needs of consumers, workers and residents alike. Diverse uses lead to greater resilience, more secure income and makes more engaging places.

Fourthly, retail and city centre assets lend themselves particularly well to the benefits of enhancing social value, which has positive impact in driving consumer loyalty. Social and environmental initiatives are not disparate functions and are most powerful when developed together. Places with better social value will also see the highest investment returns.

Fast forward thinking

Repurposing, regeneration and new retail developments all provide an opportunity to create futureproof and more impactful spaces. There is good evidence that when we create places with a green and social lens, we make better places altogether that build pride and loyalty from the people who use them.

The Funan Mall in Singapore has a blend of uses including retail and leisure, living, working, and community spaces. Green measures abound, including low carbon design, energy production, improved biodiversity, sustainable transport, green roofs and urban food production. The synergy of uses created results in reduced journeys, better social value, reduced environmental impact and strong tenant demand.

In extreme cases of retail failure stakeholders have pulled down a mall and started again, such as in Englewood, Colorado that now sees a thriving city centre where there was once a failed mall.

In Stockton-upon-Tees, the Castlegate Shopping Centre is to be replaced with a public park. This bold move by the local authority may appear extreme but is to be applauded. It’s all very well us talking up the importance of bringing in a better mix of non-retail uses in city centre centres and more people living and working in them, but why would they want to in its current state of deprivation? Improve the environment and social aspects, of any place, and you have the potential to draw people back and kick start other economic improvements.

Connected priorities

It is unfortunate the environmental agenda often still lags as priority when it comes to economic growth. However, the future for good retail investment and development is in recognising that economic and environmental sustainability are not two disparate goals, but two sides of the same coin. Those places that embrace both objectives will in turn be embraced by communities and consumers, occupational demand will follow, which must therefore be beneficial to owners and stakeholders too.

Whichever way we look at it, the cost of inaction will be a greater financial and environmental burden in the future. Shoppers and communities prefer greener, cleaner spaces and are more loyal when social value and environmental improvements are made. If we want to make more sustainable and investable retail places and city centres, it makes sound economic sense to develop through both an ESG and consumer lens, while engaging with tenants and policy makers to ensure a joined up stakeholder vision. Together, we all reap the reward.

For more on these topics, join the conversation at www.savills.com/reimaginingretail